March 6, 2026

United States Employment Slumps in February, Unemployment Rate Ticks Higher

Employment in the U.S. declined in February, according to a report released by the Labor Department on Friday. The report indicated that non-farm payroll employment fell by 92,000 jobs in February, following an increase of 126,000 jobs in January.

This decline was partly due to a reduction in healthcare employment, which fell by 28,000 jobs mainly because of strike activity. Additionally, the Labor Department reported that employment in the information sector and federal government continued to trend downward, decreasing by 11,000 jobs and 10,000 jobs, respectively. The report also noted that the unemployment rate rose to 4.4% in February, up from 4.3% in January.

On a more positive note, the Labor Department said average hourly employee earnings climbed by $0.15 or 0.4% to $37.32 in February. The annual rate of growth by average hourly employee earnings rose to 3.8% in February from 3.7% in January. 03/06/2026 - 10:00:00 (RTTNews)

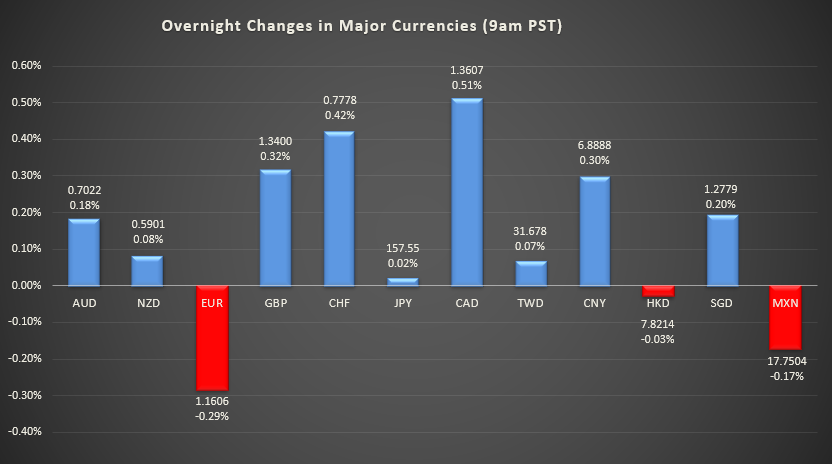

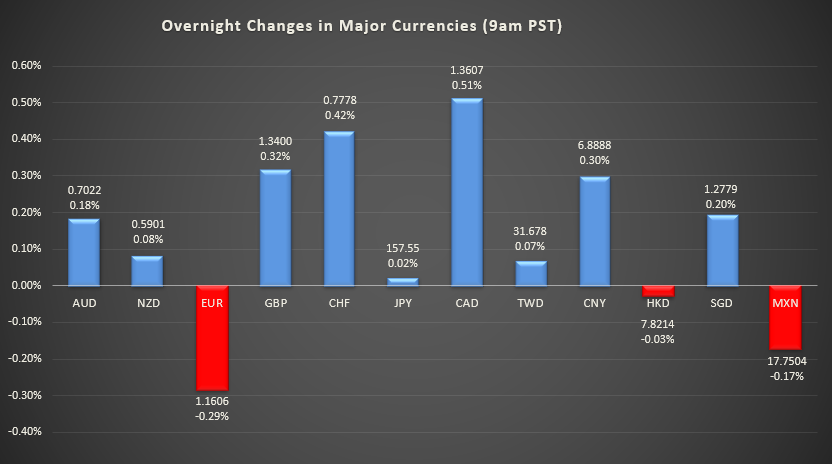

Eurozone GDP Growth to 0.2%

Euro traded at 1.1606 against USD at 9:00 AM PST

The Euro area economy experienced slow growth in the fourth quarter, primarily due to a decline in net trade.

Gross domestic product (GDP) increased by 0.2% compared to the previous quarter. In contrast, the economy grew by 0.3% in the third quarter and 0.1% in the second quarter. Year-over-year, GDP rose by 1.2%, which was slower than the 1.4% increase seen in the third quarter. For the entire year of 2025, GDP growth was recorded at 1.4%, following a 0.9% expansion in 2024.

On the expenditure side, household consumption and government spending rose by 0.4% and 0.5%, respectively. Meanwhile, gross fixed capital formation grew by 0.6% sequentially. However, exports decreased by 0.4% and imports fell by 0.2%, resulting in a negative contribution to net trade of 0.1 percentage points. Additionally, changes in inventories negatively impacted the euro area by 0.1 percentage points.

Among the member countries, Ireland faced the largest contraction at 3.8%, while the four largest economies all showed growth compared to the previous quarter. Germany and Italy both grew by 0.3%, France expanded by 0.2%, and Spain demonstrated strong growth at 0.8%.

Furthermore, the number of employed individuals increased by 0.2% from the previous quarter, consistent with the growth observed in the earlier period. The annual growth rate for employment also improved slightly, rising to 0.7% in the fourth quarter from 0.6% in the third quarter.

Japanese Yen Falls Amid Bank of Japan Policy

The Japanese yen weakened against other major currencies during the Asian session on Friday, following the Bank of Japan's (BoJ) decision to maintain stable interest rates for an extended period amidst the ongoing crises in the Middle East involving the United States, Israel, and Iran.

Although the BoJ has a long-term commitment to normalizing interest rates, Governor Kazuo Ueda indicated a potential "prolonged hold" on interest rates due to economic uncertainties stemming from the Middle East conflict. The escalating situation has led to crude oil prices spiking above $81 per barrel, resulting in ongoing supply disruptions. However, strength in energy stocks helped to mitigate the broader market's decline.

During today's Asian trading, the yen fell to a two-day low of 183.26 against the euro, down from yesterday's closing value of 182.94. Against the pound, the U.S. dollar, and the Swiss franc, the yen dropped to three-day lows of 210.92, 157.90, and 202.17, compared to Thursday's closing quotes of 210.51, 157.59, and 201.80. Additionally, against the Australian, New Zealand, and Canadian dollars, the yen slipped to 111.11, 93.26, and 115.57, down from yesterday's closing values of 110.44, 92.91, and 115.24.